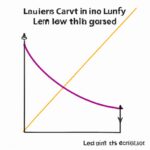

The Gini coefficient is a measure of income inequality within a population. It ranges from 0 to 1, with 0 indicating perfect equality and 1 indicating extreme inequality. To calculate it, one must first sort the population by income level. Then, a Lorenz curve is constructed, which plots the cumulative percentage of income against the cumulative percentage of the population. The Gini coefficient is obtained by dividing the area between the Lorenz curve and the line of perfect equality by the total area below the line. A lower Gini coefficient suggests a more equal distribution of income, while a higher coefficient indicates greater inequality.

Table of Contents

- Calculation methods of Gini Coefficient

- Definition of Gini Coefficient

- Historical background of Gini Coefficient

- Importance and applications of Gini Coefficient

- Limitations and criticisms of Gini Coefficient

(How to Calculate the Gini Coefficient)

The Gini coefficient is a measure of income inequality, widely used to assess the distribution of wealth within a population. It ranges from 0 to 1, where 0 represents perfect equality and 1 represents extreme inequality.

To calculate the Gini coefficient, we need a cumulative distribution function (CDF) plot, which represents the share of total income or wealth held by a given percentage of the population. The Lorenz curve is another graphical representation used for this purpose.

The first step in calculating the Gini coefficient is to plot the CDF or Lorenz curve. The second step is to calculate the area between the Lorenz curve and the line representing perfect equality (the diagonal line). This area is then divided by the area under the diagonal line.

Mathematically, the Gini coefficient (G) can be represented by the formula:

G = A / (A + B)

Where A is the area between the Lorenz curve and the diagonal line, and B is the area under the diagonal line.

A Gini coefficient of 0 indicates perfect equality, where every individual has the same income or wealth. A coefficient of 1 indicates extreme inequality, where one person possesses all the income or wealth.

Understanding and calculating the Gini coefficient allows policymakers and researchers to assess the level of income inequality within a society. It provides important insights into economic and social disparities and helps guide efforts to promote fairness and equality. By measuring and tracking the Gini coefficient over time, we can evaluate the effectiveness of policies aimed at reducing inequality and fostering inclusive growth.

Calculation methods of Gini Coefficient

Calculation methods of Gini Coefficient are essential in measuring income inequality within a population. One widely used method is the income-based approach. With this method, a country’s income distribution is divided into equal intervals or deciles. Next, the cumulative percentage of income is calculated for each interval. Gini Coefficient is then derived by subtracting the sum of the cumulative percentage of income from the Lorenz Curve.

Another popular approach is the expenditure-based method. In this method, expenditure is used as a proxy for income. A country’s population is divided into equal expenditure groups, and the cumulative percentage of expenditure is calculated for each group. Again, Gini Coefficient is derived by subtracting the sum of the cumulative percentage of expenditure from the Lorenz Curve.

Furthermore, the population-based method can be used. This method divides the population into equal groups based on the distribution of individuals, such as age or occupation. The cumulative percentage of population is then calculated for each group, and Gini Coefficient is derived by subtracting this sum from the Lorenz Curve.

Another approach is the consumption-based method. As the name suggests, this method uses consumption expenditure as a proxy for income. The population is divided into equal consumption groups, and the cumulative percentage of consumption is calculated for each group. Gini Coefficient is derived by subtracting the sum of the cumulative percentage of consumption from the Lorenz Curve.

Lastly, the asset-based method can be employed. This method focuses on the distribution of assets, such as land or wealth, within a population. The population is divided into equal asset groups, and the cumulative percentage of assets is calculated for each group. Again, Gini Coefficient is derived by subtracting the sum of the cumulative percentage of assets from the Lorenz Curve.

In conclusion, the calculation methods of Gini Coefficient provide valuable insights into income inequality. These methods, including the income-based, expenditure-based, population-based, consumption-based, and asset-based approaches, allow for a comprehensive understanding of income distribution within a population. By using these methods, policymakers and researchers can determine the extent of income inequality and design appropriate interventions to address this issue.

Definition of Gini Coefficient

The Gini coefficient is a statistical measure used to analyze income distribution within a population. It provides valuable insights into the level of inequality present in a society. The coefficient is named after the Italian statistician Corrado Gini, who developed it in 1912.

The Gini coefficient ranges from 0 to 1, with 0 representing perfect equality and 1 representing maximum inequality. A coefficient of 0 indicates that every individual in the population has the same income, while a coefficient of 1 indicates that a single individual possesses all the income, leaving everyone else with nothing.

The formula used to calculate the Gini coefficient is based on the Lorenz Curve, which plots the cumulative share of income against the cumulative share of the population. The coefficient is derived by comparing the area between the Lorenz Curve and the line of perfect equality to the total area under the line of perfect equality.

The Gini coefficient is widely used by economists, policymakers, and social scientists to measure and analyze income inequality. It provides a simple and intuitive way to visualize and compare the distribution of wealth in different countries, regions, or time periods.

A high Gini coefficient indicates a large income gap, with a small percentage of the population owning a significant portion of the wealth. This can lead to social unrest, political instability, and hinder economic development. On the other hand, a low Gini coefficient suggests a more equal distribution of income and can contribute to social cohesion and economic growth.

While the Gini coefficient is a useful tool for understanding income inequality, it has its limitations. It does not take into account other forms of inequality, such as disparities in education, healthcare, or access to resources. Additionally, it is sensitive to the number and size of income brackets used in the calculation, which can affect the accuracy of the results.

In conclusion, the Gini coefficient is a widely recognized measure of income inequality. It provides valuable insights into the distribution of wealth within a population and is an important tool for policymakers and researchers in understanding and addressing socioeconomic disparities.

Historical background of Gini Coefficient

The Gini coefficient, named after Italian statistician Corrado Gini, was developed in the early 20th century. It has since become a widely used measure of income and wealth inequality within a society. Gini was motivated to create this coefficient by his concern for social justice and the need for a quantitative measure to assess inequality.

Born in 1884 in Italy, Gini witnessed the rapid changes brought about by industrialization and the widening gap between the rich and the poor. He believed that a comprehensive measure of inequality was essential to understand and address this issue. With this in mind, Gini developed the Gini coefficient.

The Gini coefficient is a statistical measure ranging from 0 to 1, where 0 represents perfect equality (everyone has the same income or wealth) and 1 represents maximum inequality (all the income or wealth is concentrated in one individual). The coefficient is calculated by plotting a Lorenz curve, which illustrates the cumulative percentage of income or wealth against the cumulative percentage of the population.

The historical background of the Gini coefficient is crucial in understanding its significance. It not only provides a quantitative measure but also serves as a tool for policymakers and researchers to evaluate the impact of economic policies and make informed decisions. By assessing inequality levels, governments can design and implement effective measures to address the disparities within a society.

Over the years, the Gini coefficient has been refined and modified, leading to different variations of the coefficient. However, the concept remains the same – a measure that reflects the distribution of income or wealth among individuals. Its widespread use and recognition demonstrate its value in understanding and addressing social and economic issues.

In conclusion, the historical background of the Gini coefficient highlights its importance in measuring inequality within society. Developed by Corrado Gini in the early 20th century, this coefficient has become a fundamental tool for policymakers, researchers, and social justice advocates. As societies continue to grapple with income and wealth disparities, the Gini coefficient serves as a valuable resource in assessing and addressing these challenges.

Importance and applications of Gini Coefficient

The Gini coefficient is a statistical measure used to analyze income distribution within a population. It is an important tool for understanding inequality and its applications are widespread across various fields, including economics, sociology, and public policy.

One of the main reasons why the Gini coefficient is significant is its ability to provide a concise and quantitative measure of income inequality. It captures the extent to which wealth is concentrated in the hands of a few individuals or evenly distributed across society. This information is crucial for policymakers and researchers aiming to address inequality, as it allows them to assess the effectiveness of their interventions and formulate appropriate policies.

The Gini coefficient’s applications go beyond income inequality. It can also be used to analyze other types of distributions, such as education, health, or even social media engagement. For example, it can help determine the level of educational inequality by measuring the distribution of educational attainment across a population. By understanding such disparities, policymakers can design targeted interventions to improve access to education for marginalized groups.

In addition, the Gini coefficient can be used to compare inequality levels between different countries, regions, or time periods. This allows for insights into the evolution of inequality over time and across different contexts, highlighting patterns and trends that can inform policymaking and development strategies.

Furthermore, the Gini coefficient has practical applications in determining poverty levels. It provides a measure of relative poverty by examining the income distribution within society. By setting a threshold for poverty, policymakers can identify those who are most in need and allocate resources accordingly. This is crucial for effective poverty reduction strategies and social welfare programs.

Overall, the Gini coefficient is a powerful tool that provides valuable insights into income and wealth inequality. Its applications extend beyond economics and inform policymaking in various fields such as education, health, and poverty reduction. By understanding the importance of the Gini coefficient and utilizing its implications, policymakers and researchers can work towards creating a society that is more equitable and inclusive.

Limitations and criticisms of Gini Coefficient

The Gini Coefficient, which measures income inequality in a society, has been widely used and accepted. However, it is not without its limitations and criticisms.

One limitation of the Gini Coefficient is that it only considers income inequality based on a single variable – income. It does not take into account other factors that contribute to inequality, such as wealth distribution, access to education, or healthcare. This narrow focus limits the comprehensive understanding of inequality within a society.

Another criticism of the Gini Coefficient is its sensitivity to the size of the population being measured. The coefficient is affected by the number of individuals included in the calculation, leading to potential inaccuracies when comparing inequality between countries with vastly different population sizes.

Furthermore, the Gini Coefficient assumes that income distribution follows a specific mathematical model, such as the Lorenz curve. However, in reality, income distribution can often be more complex and nonlinear, making the assumptions of the Gini Coefficient questionable.

The Gini Coefficient also does not account for changes in inequality over time. It provides a snapshot of income distribution at a specific point in time, but it does not capture the dynamics of how inequality evolves and changes over a period.

Additionally, there are concerns about the accuracy of reported income data, which is the basis for calculating the Gini Coefficient. In many countries, particularly in developing economies, there can be significant issues with underreporting or misreporting of income. This can lead to inaccurate Gini Coefficient measurements, further undermining its reliability as a measure of inequality.

Critics argue that the Gini Coefficient oversimplifies the complex nature of inequality and fails to capture the full extent of social and economic disparities. It is seen as a reductionist approach to measuring inequality, lacking the depth and nuance required to fully understand the underlying causes and consequences of income disparities.

In conclusion, while the Gini Coefficient has been a useful tool for measuring income inequality, it is essential to recognize its limitations and criticisms. It is crucial to complement this measure with a broader range of indicators to gain a more comprehensive understanding of inequality and to inform effective policy interventions.