The Gini coefficient is a commonly used measure of inequality in economic and social contexts. However, it has several limitations worth noting. First and foremost, it fails to capture the full extent and dynamics of inequality within a population. It only offers a single value that does not reveal the distribution’s shape or the specific groups experiencing unequal outcomes. Moreover, the Gini coefficient disregards non-monetary dimensions of inequality and fails to account for factors such as education, health, or social mobility. Furthermore, it assumes that any redistribution of income or wealth would be problematic, favoring increased inequality over equitable distribution. In summary, the Gini coefficient provides a limited perspective on inequality and should be supplemented with additional measurements for a comprehensive analysis.

(Understanding the Gini Coefficient)

The Gini coefficient, a widely used measure of income inequality, has certain limitations that need to be taken into consideration when interpreting and utilizing its results. Firstly, the Gini coefficient only provides a single summary statistic that represents the level of inequality within a distribution. It does not offer any insights into the underlying factors that contribute to the inequality. Therefore, it lacks granularity in explaining specific causes or patterns of inequality. Another limitation is that the Gini coefficient is sensitive to changes in the middle-income range. This means that if there are significant changes in the middle-income earners, it can lead to distortions in the overall measure of inequality. Therefore, the Gini coefficient may not accurately reflect the true level of inequality when there are structural changes within the distribution of incomes. Additionally, the Gini coefficient assumes that all units within the distribution of income are comparable. However, this assumption may not hold true in practice. The coefficient does not account for differences in household sizes, demographic characteristics, or other relevant socio-economic factors that can influence the distribution of income. As a result, it may not accurately capture the inequality experienced by different social groups or individuals. Moreover, the Gini coefficient does not capture non-monetary dimensions of inequality, such as access to education, healthcare, or basic services. It solely focuses on income distribution, ignoring other important aspects of well-being and social mobility. Thus, relying solely on the Gini coefficient may provide a limited understanding of overall inequality and its consequences. In conclusion, while the Gini coefficient is a valuable tool for comparing levels of income inequality, it is important to be aware of its limitations. Its lack of granularity, sensitivity to changes in the middle-income range, inability to account for differences in household characteristics, and disregard for non-monetary dimensions of inequality must be considered when interpreting its results. Using additional measures and data sources can provide a more comprehensive understanding of inequality within a society.Alternative Measures of Inequality.

Alternative Measures of Inequality: There are several alternative measures of inequality that offer unique perspectives on wealth and income distribution within a society. While the Gini coefficient is a widely used and recognized measure, these alternative measures help to capture different aspects of inequality and supplement our understanding of economic disparities. 1. The Theil Index: The Theil Index is a measure that divides the population into groups and calculates the average logarithmic difference in income between each group. It provides insights into both within-group and between-group income disparities. The index ranges from zero to infinity, where zero indicates perfect equality. 2. Atkinson Index: Introduced by economist Anthony Atkinson, the Atkinson Index incorporates a social aversion parameter to reflect society’s concern for inequality. This measure focuses on the income share of the poorest members of society and how it affects overall inequality. By varying the aversion parameter, one can explore different social preferences for inequality reduction. 3. Palma Ratio: The Palma Ratio compares the share of national income held by the richest 10% of the population to that held by the poorest 40%. This measure provides valuable insights into the concentration of wealth within a society, highlighting the disparities between the relatively affluent and the most disadvantaged. 4. Hoover Index: The Hoover Index measures income inequality by quantifying the gap between actual income distribution and a perfectly equal society. It represents the fraction of the population that would need to change their income position to reach perfect equality. A lower Hoover Index indicates a more equal distribution of income. 5. Relative Mean Deviation: The Relative Mean Deviation measures the average deviation of incomes from the mean income. It provides information about the dispersion of incomes around the mean and suggests how much households deviate from the average. A higher deviation indicates greater income inequality. 6. Generalized Entropy Measures: Generalized entropy measures include the Atkinson, Theil, and Gini coefficients as special cases but allow for flexibility in the measurement of inequality. They enable economists to capture varying societal preferences towards inequality reduction and weight the income distribution accordingly. By using multiple measures of inequality, policymakers and researchers can gain a more comprehensive understanding of economic disparities and craft targeted strategies to address them. It is important to note that these alternative measures do not replace the Gini coefficient but rather complement it, providing a deeper analysis of different aspects of income and wealth distribution.

Assumptions and Interpretations of Gini Coefficient

The Gini coefficient is a commonly used measure of income inequality, but it is not without its limitations. One important aspect to consider when using the Gini coefficient is the various assumptions and interpretations associated with it. These assumptions and interpretations can affect the accuracy and applicability of the coefficient in different contexts. One assumption of the Gini coefficient is that it assumes a continuous income distribution. It assumes that income levels can be ordered on a continuous scale, which may not always be the case in real-world scenarios. If the income distribution is not continuous, the Gini coefficient may not accurately capture the level of inequality present. Another assumption is that the Gini coefficient assumes that all variables affecting income distribution are accounted for in the measurement. However, in reality, there may be other factors at play that are not considered, such as social factors, cultural differences, or differences in access to education and opportunities. These factors can significantly impact income distribution and inequality levels, making the Gini coefficient a limited tool for capturing the complete picture. Interpreting the Gini coefficient requires a careful understanding of its scale. The coefficient ranges from 0 to 1, where 0 represents perfect equality (i.e., everyone has the same income) and 1 represents maximum inequality (i.e., one person has all the income). However, it is essential to note that the interpretation of the coefficient can vary depending on the context and the scale of measurement. Different countries or regions may have different levels of inequality, making it necessary to compare coefficients within the same context. Additionally, the Gini coefficient does not provide insights into the underlying reasons for income inequality. It merely measures the degree of inequality but does not shed light on the factors responsible for it. To gain a comprehensive understanding of income inequality, additional measures and analysis are required to identify the specific causes and potential solutions. In summary, the assumptions and interpretations of the Gini coefficient play a significant role in its application and utility. These assumptions, such as the continuous income distribution and the completeness of variables considered, must be considered when interpreting the coefficient’s results. Furthermore, the interpretation of the coefficient requires context-specific analysis and comparisons. While the Gini coefficient provides a valuable measure of income inequality, it is necessary to recognize its limitations and employ additional tools and analysis for a more comprehensive understanding.

Definition and Calculation of Gini Coefficient

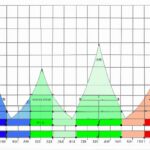

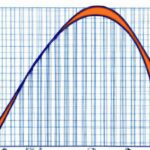

The Gini coefficient is a statistical measure used to represent income inequality within a population or distribution. It quantifies the inequality by incorporating the dispersion of income or wealth among individuals or groups. The Gini coefficient ranges between 0 and 1, where 0 represents perfect equality (everyone has the same income or wealth) and 1 represents maximum inequality (one individual has all the income or wealth). Calculation of the Gini coefficient involves a step-by-step process. First, the cumulative proportion of the population is plotted on the x-axis, while the cumulative proportion of income or wealth is plotted on the y-axis. This graphical representation is known as the Lorenz curve. The Lorenz curve helps visualize the level of inequality within the distribution. The next step is to calculate the area between the Lorenz curve and the line of perfect equality (the 45-degree line from the origin). This area is also known as the area under the Lorenz curve (A). Mathematically, it is expressed as the integral of the Lorenz curve function. The smaller the area, the lower the inequality in the distribution. The Gini coefficient is calculated by dividing the area between the Lorenz curve and the line of perfect equality (A) by the total area under the line of perfect equality (A + B). The value is then subtracted from 1 to obtain the Gini coefficient. Mathematically, the formula for calculating the Gini coefficient is as follows: Gini Coefficient = 1 – (A / (A + B)) Where A represents the area between the Lorenz curve and the line of perfect equality, and B represents the total area under the line of perfect equality. The resulting Gini coefficient provides a measure of inequality, with higher values indicating greater inequality and lower values indicating lower inequality. It is a concise and standardized metric widely used in social sciences and economics to compare inequality levels across different populations or timeframes. Understanding the definition and calculation of the Gini coefficient is essential for policymakers, researchers, and analysts when examining income or wealth disparities within a population. By accurately quantifying inequality, they can formulate more effective policies and interventions to promote greater equity and fairness in society.

Income Distribution Issues

Income Distribution Issues refer to the various challenges and concerns related to the way wealth and income are distributed among individuals and households within a society. These issues are crucial in understanding the limitations of the Gini coefficient, which is a widely used measure of income inequality. One of the key concerns with income distribution is the presence of income disparities. Income disparities occur when there is a significant gap between the highest and lowest income earners in a society. This often leads to a concentration of wealth in the hands of a few individuals or groups while others struggle to meet their basic needs. Such disparities can result in social and economic imbalances, as well as hinder social mobility and exacerbate poverty. Another income distribution issue is the existence of a middle-income trap. In some societies, there is a lack of a robust middle-class population, with a majority of individuals falling into either the low-income or high-income brackets. Having a substantial middle-income group is important for socioeconomic stability, as it contributes to a more equitable distribution of resources and supports overall economic growth. When this balance is missing, it can lead to increased social tensions and inequality. One notable income distribution issue is the gender wage gap. Despite advancements in gender equality, women continue to face wage discrimination compared to their male counterparts. This wage gap is often attributed to factors such as occupational segregation, biased hiring practices, and family-care responsibilities that disproportionately affect women’s career progression. The gender wage gap not only perpetuates inequality, but it also has broader societal implications, as it can hinder women’s economic empowerment and limit overall economic growth. An additional income distribution issue is regional disparities. Many countries experience significant differences in income and wealth across different regions within their borders. This could be due to factors such as uneven economic development, varying access to resources, and disparities in infrastructure. Regional disparities can create a sense of marginalization among certain communities, leading to social unrest and further exacerbating income inequality within a country. Furthermore, informal economies and income underreporting pose challenges to accurately measuring income distribution. Informal economies often operate outside the regulatory frameworks, making it difficult to capture their true contributions to national income. Additionally, individuals may underreport their earnings to avoid taxation or for other reasons, resulting in inaccurate income distribution data. In conclusion, income distribution issues are multifaceted and complex, and they underscore the limitations of the Gini coefficient and other measures of income inequality. Addressing these issues requires comprehensive policy measures that promote equal opportunities, fair wages, and inclusive economic growth to ensure a more equitable distribution of income and wealth within societies.

Sampling and Data Limitations

Sampling and Data Limitations Sampling and data limitations are significant challenges when using the Gini coefficient to measure income inequality. These limitations arise from the nature of the data used and the method of sampling. It is crucial to understand these limitations to ensure accurate and reliable interpretations of Gini coefficient results. One of the primary concerns is the representativeness of the sample. The Gini coefficient requires data on income distribution across different individuals or households. However, obtaining a representative sample that accurately reflects the entire population can be difficult. Sampling techniques must be carefully chosen to avoid biases and ensure that the selected sample truly represents the whole population. Failure to achieve this can lead to misleading results and incorrect interpretations of income inequality. Another limitation is related to the quality and accuracy of the data itself. In many cases, income data is derived from self-reported surveys or administrative records. Self-reported surveys are subject to reporting biases, as individuals may not accurately report their income due to various reasons like privacy concerns or social desirability biases. Similarly, administrative records may have inaccuracies or missing data, which can affect the validity of Gini coefficient estimates. It is crucial to address these limitations and consider the potential impact they can have on the final results. Data limitations also arise due to the lack of standardized income definitions and measurement techniques across different countries or studies. Income can be defined differently depending on the context or purpose, making it challenging to compare Gini coefficients between different datasets or regions. Moreover, different studies may use alternative measures of income, such as pre-tax income, post-tax income, or disposable income, further complicating the comparison of Gini coefficients. These variations in measurements hinder the establishment of consistent and comparable global income inequality trends. Furthermore, Gini coefficient calculations can be affected by issues like skewed income distributions and outliers. The Gini coefficient assumes that income distribution follows a specific pattern, but in reality, income distributions can be highly skewed, with a small proportion of the population earning a significant share of the total income. In such cases, the Gini coefficient may not accurately capture the full extent of income inequality, as it is more sensitive to changes in the middle-income brackets. Additionally, the presence of outliers, extreme values that deviate significantly from the overall pattern, can distort the Gini coefficient results. Outliers can arise from various factors, such as high-income individuals or households, which can significantly impact the overall income inequality measure. In conclusion, sampling and data limitations pose significant challenges in accurately measuring income inequality using the Gini coefficient. Careful consideration of sampling techniques, data quality, standardized measurements, and the presence of outliers is necessary to ensure valid and meaningful interpretations of the Gini coefficient results. Acknowledging these limitations and addressing them appropriately is essential for researchers, policymakers, and analysts in understanding and addressing income inequality effectively.