The Gini coefficient is a statistical measure used to quantify income and wealth inequality within a particular population. It ranges from 0 to 1, where 0 represents perfect equality (everyone has the same income or wealth) and 1 represents complete inequality (one person has all the income or wealth). The coefficient is derived from a Lorenz curve, which plots cumulative income or wealth against the cumulative percentage of the population. A higher Gini coefficient indicates greater inequality, highlighting disparities between the rich and poor. It is a widely utilized tool in economic and social research to assess the distribution of resources and evaluate policy impacts on inequality.

(Gini Coefficient and Lorenz Curve)

The Gini coefficient is a measure of income or wealth inequality within a population. It is commonly used to assess the level of economic inequality in a country and is named after the Italian statistician Corrado Gini, who developed the concept in 1912. The Gini coefficient ranges from 0 to 1, with 0 representing perfect equality and 1 representing extreme inequality. A Gini coefficient of 0 indicates that every individual has an equal share of income or wealth, while a coefficient of 1 suggests that a single individual possesses all the income or wealth, with everyone else having nothing. To calculate the Gini coefficient, a Lorenz curve is used. The Lorenz curve plots the cumulative share of the population on the horizontal axis against the cumulative share of income or wealth on the vertical axis. The Gini coefficient is derived by measuring the area lying between the Lorenz curve and the line of perfect equality, which is also known as the Gini coefficient curve. The Gini coefficient can be applied at various levels, such as global, national, regional, or even within specific groups or industries. It provides a concise and quantitative measure of income or wealth distribution, allowing policymakers and researchers to compare levels of inequality across different countries or time periods. Understanding the Gini coefficient is important as it sheds light on the social and economic disparities faced by different segments of a population. High levels of inequality can lead to social unrest, reduced social mobility, and economic inefficiencies. Therefore, policymakers often utilize the Gini coefficient to inform decisions on taxation, social welfare programs, and other policies aimed at addressing disparities and promoting a more equitable society. In conclusion, the Gini coefficient is a statistical tool used to measure income or wealth inequality within a population. It provides a numerical representation of inequality, ranging from 0 to 1, with higher values indicating greater disparities. Understanding and monitoring the Gini coefficient can contribute to informed policy decisions aimed at reducing inequality and promoting social and economic well-being.Calculation of Gini coefficient

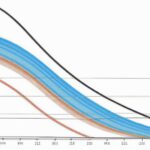

The Gini coefficient is a measure of income inequality within a given population. It provides a numerical representation of the income distribution among individuals or households in a country or region. The calculation of the Gini coefficient involves several steps, which enable researchers and policymakers to understand the extent of income disparities present within a society. To calculate the Gini coefficient, the first step is to compile income data. This data can be obtained from various sources, including individual tax returns, household surveys, or national income accounts. The collected data should provide a representative sample of the population in order to accurately reflect the income distribution. Once the income data is collected, the next step is to arrange it in ascending order. This means that the lowest incomes are listed first, while the highest incomes are listed last. This arrangement is crucial for the subsequent calculations involved in determining the Gini coefficient. After arranging the income data, the next step is to calculate the cumulative shares of both income and population. This can be done by dividing the sum of incomes of a certain group by the total sum of incomes for the entire population. Similarly, the cumulative population can be calculated by dividing the number of people in a certain income group by the total population. With the cumulative shares of income and population calculated, the next step involves generating a Lorenz curve. The Lorenz curve is a graphical representation of the income distribution, which plots the cumulative share of income on the vertical axis against the cumulative share of the population on the horizontal axis. The curve starts at the origin and ends at 100% of the population and 100% of the income. To calculate the Gini coefficient, one must measure the area between the Lorenz curve and the line of perfect equality, which represents a society with perfect income distribution. This area is commonly referred to as the Gini index. There are several methods to calculate this index, including the graphical method and numerical integration. The graphical method involves measuring the area between the Lorenz curve and the line of perfect equality using a trapezoidal rule or Simpson’s rule. This approach involves breaking down the area into several trapezoids or smaller shapes and summing their areas to arrive at an approximation of the Gini index. Numerical integration, on the other hand, involves calculating the definite integral of the Lorenz curve function. This method provides a more accurate calculation of the Gini index, especially when the income distribution is complex or nonlinear. Once the area between the Lorenz curve and the line of perfect equality is calculated, it is divided by the total area under the line of perfect equality to obtain the Gini coefficient. The coefficient ranges between 0 and 1, where 0 represents perfect income equality, and 1 represents maximum income inequality. In conclusion, the calculation of the Gini coefficient involves arranging income data, calculating cumulative shares of income and population, generating a Lorenz curve, and measuring the area between the Lorenz curve and the line of perfect equality. This statistical measure provides insights into income distribution and helps policymakers and researchers understand the degree of income inequality within a given population.

Factors affecting Gini coefficient

Factors Affecting Gini Coefficient: 1. Income distribution: One of the primary factors influencing the Gini coefficient is the distribution of income within a society. Generally, a larger income gap between the rich and the poor leads to a higher Gini coefficient, indicating greater income inequality. Conversely, a more equal distribution of income results in a lower Gini coefficient. 2. Economic policies: Government policies and economic systems play a significant role in determining the Gini coefficient. Policies that focus on wealth redistribution and reducing income disparities, such as progressive taxation, social welfare programs, and minimum wage laws, tend to lower the Gini coefficient. In contrast, policies that promote economic growth but do not adequately address income inequality can contribute to a higher Gini coefficient. 3. Education and human capital: Access to quality education and skill development opportunities are crucial factors influencing income inequality. Countries with well-functioning education systems that provide equal opportunities for all citizens tend to have lower levels of income inequality, resulting in a lower Gini coefficient. Education and human capital development can help individuals earn higher incomes and contribute to a more equal society. 4. Labor market conditions: The state of the labor market, such as employment rates, wages, and job stability, significantly affects income inequality. High unemployment rates and low wages can exacerbate income disparities, leading to an increase in the Gini coefficient. Conversely, a strong labor market with good job prospects and fair wages can help reduce income inequality. 5. Social mobility: The ability of individuals to move up or down the income ladder, known as social mobility, is closely linked to income inequality. In societies with low social mobility, where people are less likely to move out of their socioeconomic class, income inequality tends to be higher. On the other hand, societies that prioritize equal opportunities and promote social mobility experience lower levels of income inequality and thus a lower Gini coefficient. 6. Globalization and technological advancements: The impact of globalization and technological progress on income inequality is complex. While globalization can create new economic opportunities and increase overall prosperity, it can also widen income gaps, particularly for those with low skills or in vulnerable industries. Similarly, technological advancements can lead to skill-biased income inequality, where individuals with advanced skills benefit disproportionately, potentially increasing the Gini coefficient. 7. Social factors: Factors such as gender, ethnicity, and discrimination can contribute to income inequality and affect the Gini coefficient. In many societies, women and minority groups face systemic barriers that limit their access to equal opportunities and fair compensation. Addressing these social factors is crucial for reducing income inequality and achieving a more equitable Gini coefficient. In conclusion, the Gini coefficient is influenced by a variety of factors ranging from income distribution and economic policies to education, labor market conditions, social mobility, globalization, technological advancements, and social factors such as gender and discrimination. Understanding these factors and implementing appropriate policies can help societies reduce income inequality and achieve a more equitable distribution of wealth.

Interpretation of Gini coefficient

Interpretation of Gini coefficient: The Gini coefficient is a widely used measure of income inequality and wealth distribution in a given population. It provides insights into the distribution of incomes or wealth among the individuals in that population. Understanding how to interpret the Gini coefficient is essential for drawing meaningful conclusions and making informed policy decisions. Here, we discuss the key points to consider when interpreting the Gini coefficient. First and foremost, the Gini coefficient ranges between 0 and 1, where 0 represents perfect equality (every individual has the same income or wealth) and 1 represents extreme inequality (one individual has all the income or wealth, while others have none). Values closer to 0 indicate a more equal distribution, while values closer to 1 indicate a more unequal distribution. The Gini coefficient can be easily interpreted by comparing it to the theoretical extremes mentioned above. For instance, a coefficient of 0.2 suggests a relatively equal distribution, whereas a coefficient of 0.8 indicates a highly unequal distribution. However, it is important to note that any interpretation should consider the context and specific circumstances of the population being analyzed. Another aspect to consider is the trend of the Gini coefficient over time. By comparing Gini coefficients calculated for different years or periods, we can assess whether income inequality is increasing or decreasing. If the coefficient increases over time, it implies a worsening income distribution, indicating a larger gap between the rich and the poor. Conversely, a decreasing coefficient signals improved income equality. It is also important to consider the Gini coefficient in relation to other economic and social indicators. For example, a high Gini coefficient may be accompanied by low social mobility, limited access to education, or inadequate healthcare systems. Evaluating the Gini coefficient alongside these factors can provide a comprehensive understanding of the overall socioeconomic landscape and help identify potential drivers of inequality. Furthermore, the interpretation of the Gini coefficient should take into account the population under analysis. Different countries, regions, or demographic groups may have varying levels of income inequality. Therefore, comparing Gini coefficients between different populations should be done with caution, considering factors such as economic development, cultural norms, and social policies. Lastly, it is crucial to recognize that the Gini coefficient does not provide a complete picture of income or wealth distribution. It focuses solely on the concentration of income or wealth and neglects other dimensions such as the absolute level of poverty or living standards. Therefore, it is recommended to utilize the Gini coefficient in conjunction with other indicators to capture a more comprehensive understanding of the economic and social dynamics. In conclusion, interpreting the Gini coefficient involves considering its range, trend over time, comparison with other indicators, population characteristics, and its limitations. By doing so, policymakers, researchers, and analysts can gain valuable insights into income inequality and make informed decisions to promote more equitable societies.

Limitations of Gini coefficient

The Gini coefficient is a widely used measure of income inequality and wealth distribution. While it provides valuable insights into the inequality within a society, it also has some limitations that should be taken into consideration. Here are some key limitations of the Gini coefficient: 1. Incomplete Picture: The Gini coefficient only measures inequality in terms of income or wealth distribution. It does not take into account other important factors such as access to education, healthcare, or social mobility. Therefore, it cannot provide a comprehensive view of overall societal well-being or opportunity. 2. Insensitivity to Changes in the Middle Class: The Gini coefficient is particularly sensitive to changes at the extremes of the income distribution, but it is less sensitive to changes in the middle class. As a result, it may not accurately capture shifts in income distribution that mainly affect the middle-income earners. This can lead to an incomplete understanding of changes in inequality. 3. Distribution of Household Sizes and Composition: The Gini coefficient does not consider differences in household sizes or composition. It treats all households as equal, regardless of the number of members or their age structure. This can be problematic, as larger households often have higher expenses and require more resources, which can impact their overall income inequality. 4. Lack of Regional Differentiation: The Gini coefficient does not provide a breakdown of inequality at a regional or local level. It only provides a broad perspective on income inequality at the national or international level, without considering the significant variations that may exist within specific regions or cities. This limitation can hinder policymakers’ abilities to address localized inequalities effectively. 5. Inability to Capture Informal Economy: The Gini coefficient relies heavily on formal income data, often obtained through household surveys or tax records. However, it fails to capture income and wealth generated from informal economy activities, which are prevalent in many developing countries. This exclusion can be particularly problematic as informal economies often contribute significantly to income and wealth disparities. 6. Lack of Time Dimension: The Gini coefficient provides a snapshot of income or wealth inequality at a specific moment in time. It does not consider the changes and dynamics that occur over time, such as social mobility or income mobility. This limitation prevents a comprehensive understanding of the trends and patterns in inequality. In conclusion, while the Gini coefficient is a useful tool in measuring income or wealth inequality, it has its limitations. It does not capture the entire picture of societal well-being and is sensitive to changes at the extremes of the income distribution, while less sensitive to changes in the middle class. Moreover, it does not consider household composition, regional variations, informal economies, or changes over time. Recognizing these limitations is essential to gaining a more comprehensive understanding of inequality and formulating appropriate policies to address it.

What is Gini coefficient

The Gini coefficient is a statistical measure used to represent income inequality within a population. It provides a numerical indication of the distribution of income or wealth among the members of a specific group, such as a country or region. The coefficient is widely utilized by economists, policymakers, and researchers to assess the level of inequality and understand the disparity of the income distribution. The Gini coefficient ranges between 0 and 1, where 0 represents perfect equality (when everyone earns the same income) and 1 indicates extreme inequality (when a single individual possesses all the income or wealth). An equal distribution of income would result in a Gini coefficient of 0, while a highly skewed distribution would yield a Gini coefficient closer to 1. The calculation of the Gini coefficient is based on the Lorenz curve, which plots the cumulative percentage of total income received against the corresponding cumulative percentage of the population. The line of perfect equality would be a straight, diagonal line from the origin, while the actual Lorenz curve represents the income distribution within the population. The Gini coefficient is derived by calculating the area between the Lorenz curve and the line of perfect equality, expressed as a ratio to the total area under the line of perfect equality. By analyzing the Gini coefficient, economists gain insights into the extent of income inequality within a society, helping to measure the overall economic well-being and social stability of a population. A higher Gini coefficient suggests that a smaller portion of the total income is earned by a larger fraction of the population. This may indicate a larger wealth gap, limited economic mobility, and possible social tensions within a society. Conversely, a lower Gini coefficient signifies a more equal distribution of income, indicating a society in which wealth and resources are more evenly shared among its members. Economies with lower Gini coefficients are often associated with greater social inclusion, higher levels of trust and cooperation, and increased economic opportunities for all individuals. It is important to note that the Gini coefficient on its own cannot provide a complete picture of income inequality. It offers a snapshot of the overall inequality within a population, but it does not reveal the underlying factors contributing to the inequality or the specific distribution patterns among different socioeconomic groups. Despite its limitations, the Gini coefficient remains a widely recognized and essential tool for policymakers and researchers to monitor and address income inequality. By understanding the extent of the problem and its implications, policymakers can formulate targeted interventions to promote more equitable growth and social development.