The Gini coefficient is a commonly used measure of income inequality within a population. Several factors can influence this coefficient. First, the distribution of income and wealth plays a crucial role – the more unequal the distribution, the higher the Gini coefficient. Additionally, the level of economic development can impact income inequality, as countries with higher per capita income tend to have lower inequality. Other factors include government policies, such as taxation and social welfare programs, which can either reduce or exacerbate inequality. Furthermore, demographic factors like education, gender, and ethnicity can also affect income distribution and subsequently impact the Gini coefficient. These various factors interact in complex ways, shaping the overall level of income inequality within a society.

(Lorenz Curve and Gini Coefficient – Measures of Income Inequality)

The Gini coefficient is a widely-used statistical measure of inequality within a society. It ranges from 0 to 1, where 0 represents perfect equality and 1 represents maximum inequality. Numerous factors contribute to the variation in Gini coefficient values across different countries and regions. Let’s explore some of the key factors affecting the Gini coefficient. 1. Income distribution: One of the primary factors influencing the Gini coefficient is the distribution of income among individuals or households. If income is evenly distributed, the Gini coefficient will be lower, indicating less inequality. Conversely, if a significant portion of income is concentrated in the hands of a few individuals or a particular group, the Gini coefficient will be higher. 2. Economic policies: Government policies and economic frameworks play a crucial role in income distribution and, consequently, the Gini coefficient. Policies that promote social welfare, progressive taxation, and redistribution of wealth can help reduce income inequality and lower the Gini coefficient. 3. Education and skills: The educational attainment and skill level of a population can impact income inequality. Higher education levels and skill acquisition tend to lead to higher-paying jobs, reducing inequality. Investments in education and skill development can, therefore, contribute to a more equal income distribution. 4. Employment opportunities: Access to quality job opportunities is another significant factor influencing the Gini coefficient. In economies with limited employment prospects, income inequality tends to be higher, as a small segment of the population may control a disproportionate share of wealth. 5. Social and cultural dynamics: Societal and cultural factors, such as discrimination, social exclusion, and gender inequality, can contribute to income disparities and affect the Gini coefficient. These dynamics can lead to unequal access to resources and opportunities, exacerbating inequality. 6. Globalization and technological advancements: The forces of globalization and technological progress have had mixed effects on income distribution. While globalization can open up new opportunities and reduce inequality in some cases, it can also concentrate wealth in the hands of a few, leading to heightened inequality. Understanding the various factors that influence the Gini coefficient is crucial for policymakers and researchers aiming to address income inequality effectively. By identifying these factors and implementing targeted interventions, societies can work towards creating a more equitable distribution of wealth and opportunity.Calculation of Gini coefficient

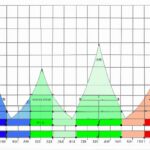

The calculation of the Gini coefficient is a widely used method to measure income inequality within a population. It provides a numerical value that ranges between 0 and 1, where 0 represents perfect equality and 1 represents extreme inequality. The Gini coefficient is employed by economists, policymakers, and researchers to measure and compare income disparities and analyze the effectiveness of economic policies. The calculation itself involves a series of steps aimed at quantifying the distribution of income among individuals or households. To compute the Gini coefficient, it is necessary to have data on the income distribution of a particular population. This information should include individual income levels or household incomes. The more detailed and accurate the data, the more reliable the Gini coefficient will be. The first step in the calculation process is to organize the income data in ascending order, from the lowest to the highest. This establishes a distribution curve referred to as the Lorenz curve. The X-axis of this curve represents the cumulative share of the population, while the Y-axis represents the cumulative share of the income. Next, a line of perfect equality is drawn on the Lorenz curve, which represents a hypothetical scenario in which income would be distributed equally among all individuals. This line begins at the origin and proceeds diagonally until it reaches the point of a perfect inequality, which is the highest income level. This line acts as a reference for the Gini coefficient calculation. The next step involves calculating the area between the Lorenz curve and the line of perfect equality. This area is obtained by subtracting the cumulative area between the Lorenz curve and the X-axis from the triangular area between the line of perfect equality and the Lorenz curve. The larger the area between the Lorenz curve and the line of perfect equality, the higher the degree of income inequality will be, resulting in a higher Gini coefficient value. Finally, to obtain the Gini coefficient, the area between the Lorenz curve and the line of perfect equality is normalized by dividing it by the total area under the line of perfect equality. The resulting value represents the Gini coefficient associated with the income distribution being analyzed. It is important to note that the Gini coefficient is just one of several methods used to measure income inequality, and it has its limitations. For instance, it doesn’t take into account factors such as wealth distribution, non-monetary income, or access to public services. Additionally, variations in data collection methods and the choice of intervals for income groups may affect the calculated Gini coefficient. Despite its limitations, the Gini coefficient remains a widely accepted and useful tool for measuring income inequality, allowing policymakers and researchers to monitor changes in social and economic conditions and design appropriate interventions to address income disparities.

Definition of Gini coefficient

The Gini coefficient is a widely used measure of income inequality within a population. It was developed by Italian statistician Corrado Gini in 1912 and has since become a standard tool for analyzing and comparing disparities in wealth distribution. The Gini coefficient is a single summary statistic that quantifies the degree of income inequality in a given society. It ranges from 0 to 1, where 0 represents perfect equality (i.e., every individual in the population has exactly the same income) and 1 represents perfect inequality (i.e., one individual has all the income while the rest have none). To calculate the Gini coefficient, income data for each individual in the population is typically arranged in ascending order. Next, a Lorenz curve is constructed by plotting the cumulative share of total income on the y-axis and the cumulative share of the population on the x-axis. The closer the Lorenz curve is to the line of perfect equality, the lower the Gini coefficient and the more equal the income distribution is. The Gini coefficient can be interpreted as the area between the Lorenz curve and the line of perfect equality, expressed as a proportion of the total area under the line of perfect equality. It represents the proportion of income that would need to be redistributed in order to achieve perfect equality. A Gini coefficient of 0.5, for example, would suggest that 50% of the income would need to be redistributed in order for the population to have equal income shares. A Gini coefficient of 0.2, on the other hand, would imply that only 20% of the income needs to be redistributed to achieve the same level of equality. The Gini coefficient has several advantages as a measure of income inequality. Firstly, it provides a simple and intuitive summary of inequality, allowing for easy comparisons between different countries or time periods. Secondly, it takes into account the entire income distribution rather than focusing solely on the extremes, providing a more comprehensive picture of inequality. Lastly, it can be calculated using data from various sources, ranging from individual incomes to household incomes or even broader measures such as national income. However, it is important to note that the Gini coefficient has its limitations. It is a static measure, meaning it only provides a snapshot of income inequality at a particular point in time. Changes in inequality over time or differences in the distribution of income across different groups within a population may not be fully captured. Additionally, the Gini coefficient does not provide information on the underlying causes of income inequality, such as differences in education, skills, or access to opportunities. Despite these limitations, the Gini coefficient remains a widely used and valuable tool for researchers, policymakers, and analysts seeking to understand and address income inequality. Its simplicity and ability to summarize complex information into a single number make it an essential component of any comprehensive analysis of income distribution.

Economic factors influencing the Gini coefficient

Economic factors play a significant role in influencing the Gini coefficient, which is a measure of income inequality within a particular population. These factors can help explain the disparities in income distribution and shed light on the various economic forces at play. Here are some key economic factors that influence the Gini coefficient: 1. Economic growth: The level of economic growth within a country can influence the Gini coefficient. In general, faster-growing economies tend to experience lower levels of income inequality. This is because economic growth creates new job opportunities and raises incomes for a larger proportion of the population, potentially reducing income disparities. 2. Labor market conditions: The state of the labor market, including factors such as employment levels, wages, and job opportunities, can affect income inequality. When the labor market is strong and robust, it tends to reduce income disparities as more individuals have access to decent-paying jobs. 3. Education and skills: The level of education and skills possessed by individuals within a society can impact income distribution. Higher levels of education and skill acquisition often result in better job prospects and higher wages, potentially reducing income inequality. Conversely, when access to quality education is limited, income disparities may widen. 4. Government policies and taxation: Government policies and taxation systems can have a significant impact on income inequality. Progressive tax systems and social welfare programs can help redistribute income and reduce inequality. On the other hand, policies that favor the wealthy or lack progressive taxation mechanisms may exacerbate income disparities. 5. Globalization and trade: The process of globalization and international trade can influence income inequality within a country. Globalization can lead to both positive and negative effects on income distribution. Increased trade and globalization can create new economic opportunities, but they can also create winners and losers, potentially widening income disparities. 6. Industry and sector composition: The structure of the economy, including the dominant industries and sectors, can influence the Gini coefficient. Some industries or sectors may offer higher wages and better income prospects, leading to lower levels of income inequality. Conversely, certain sectors, such as low-skilled or informal labor, may have higher levels of income inequality. 7. Financial market conditions: The state of financial markets, including access to credit and capital, can affect income inequality. Unequal access to financial resources and opportunities can perpetuate income disparities, with the wealthy having greater access to capital and investment opportunities. Understanding these economic factors can provide valuable insights into the causes of income inequality and help policymakers formulate strategies to address it. By focusing on addressing these factors, societies can aim to create more equitable income distributions and promote fair economic opportunities for all.

Income inequality

Income inequality refers to the extent to which income is distributed unevenly among a population. It is a significant aspect of social and economic dynamics, and it often serves as a proxy measure for overall economic inequality within a society. Understanding the factors that contribute to income inequality is crucial in order to devise policies and interventions aimed at reducing disparities and promoting more equitable societies. One key driver of income inequality is the disparity in wages and salaries. In many countries, individuals with higher levels of education and skill often earn significantly more than those with lower levels of education. This disparity is known as the education premium and is a result of supply and demand dynamics in the labor market. Industries and sectors that require specialized knowledge or technical expertise tend to offer higher salaries, leading to income disparities between different occupational groups. Another contributing factor to income inequality is the phenomenon of globalization. The increased integration of economies has resulted in the outsourcing of labor-intensive industries to countries with lower labor costs. This has led to job losses and wage stagnation for workers in high-income countries, while creating opportunities for low-skilled workers in emerging economies. The uneven distribution of the benefits of globalization has exacerbated income inequalities within and between countries. Furthermore, technological advancements and automation have also had a profound impact on income distribution. The rise of automation has led to the displacement of workers in certain industries, particularly those involved in routine and repetitive tasks. This has resulted in job polarization, with a shrinking middle class and an increase in both high-skilled, high-wage jobs and low-skilled, low-wage jobs. Technological progress has further widened the income gap as individuals with the necessary skills to adapt to the changes benefit from higher wages, while those who are unable to adapt face income stagnation or declines. Tax policies and social welfare systems also play a role in income inequality. Progressive tax systems, where higher-income individuals are subject to higher tax rates, can help redistribute wealth and reduce income disparities. Similarly, robust social welfare programs, such as unemployment benefits, healthcare, and affordable housing, can provide a safety net for vulnerable populations and mitigate the effects of income inequality. Lastly, systemic discrimination and social barriers can significantly contribute to income inequality. Discrimination based on gender, race, ethnicity, or other factors can lead to disparities in access to education, employment opportunities, and career advancement. These inequalities perpetuate income disparities and hinder social mobility, as individuals from marginalized groups face a greater struggle to earn higher incomes and accumulate wealth. Understanding the factors influencing income inequality is crucial for policymakers and researchers in order to develop evidence-based strategies to reduce disparities and promote social and economic inclusivity. By addressing the root causes of income inequality, societies can strive towards a more just and equitable distribution of wealth and opportunities.

Social factors influencing the Gini coefficient.

Social factors play a significant role in shaping the Gini coefficient, which is a widely used measure of income inequality within a society. These factors encompass a range of sociocultural and demographic aspects that influence income distribution and contribute to the inequality observed within a country or region. Here are some social factors that can influence the Gini coefficient: 1. Education: The level and quality of education within a society can greatly impact income inequality. A well-educated population tends to have higher employment opportunities and access to better-paying jobs, resulting in a more equal distribution of income. In contrast, limited access to education can lead to a larger income gap between skilled and unskilled workers. 2. Occupational structure: The distribution of different occupations within a society affects income inequality. Industries with higher-paying jobs, such as technology or finance, can create wider income disparities compared to industries that offer more equal pay, such as public services. An imbalanced occupational structure contributes to income inequality by influencing the earnings potential of different groups. 3. Discrimination and social bias: Discrimination based on characteristics such as gender, race, ethnicity, or social class can significantly affect income distribution. Unequal opportunities due to discrimination or bias can limit individuals’ access to education, employment, and other resources, further deepening income inequality. 4. Social safety nets: The presence and effectiveness of social safety net programs impact income distribution. Countries with well-designed social welfare systems, such as strong healthcare, education, and social assistance programs, tend to experience lower income inequality. These programs provide support to those in need and help reduce poverty levels. 5. Social mobility: The ability of individuals to move up or down the income ladder, known as social mobility, is an essential social factor influencing income inequality. Societies with high levels of social mobility tend to have lower income inequality as individuals have better opportunities to improve their economic status. In contrast, limited social mobility can perpetuate income inequality, leading to a concentration of wealth in certain segments of society. 6. Cultural norms and values: Societal beliefs and cultural norms can affect income inequality. For example, cultural ideals emphasizing meritocracy may result in greater income disparities as individuals are rewarded based on their achievements and abilities. In contrast, societies that prioritize values like egalitarianism may experience lower income inequality by promoting a more equal distribution of resources. Understanding these social factors is crucial for policymakers and researchers to address issues related to income inequality. By focusing on improving education systems, reducing discrimination and bias, strengthening social safety nets, promoting social mobility, and aligning cultural norms with equality, societies can work towards reducing income inequality and creating a more equitable society.